|

|

Joined: Sep 2006

Posts: 5,991

Hall of Famer

|

Hall of Famer

Joined: Sep 2006

Posts: 5,991 |

Quote:

Quote:

Quote:

Quote:

If the US would lower those corporate rates, more companies would come back and base their companies here

How much lower can you go, though, without putting yourself on par with a banana republic?

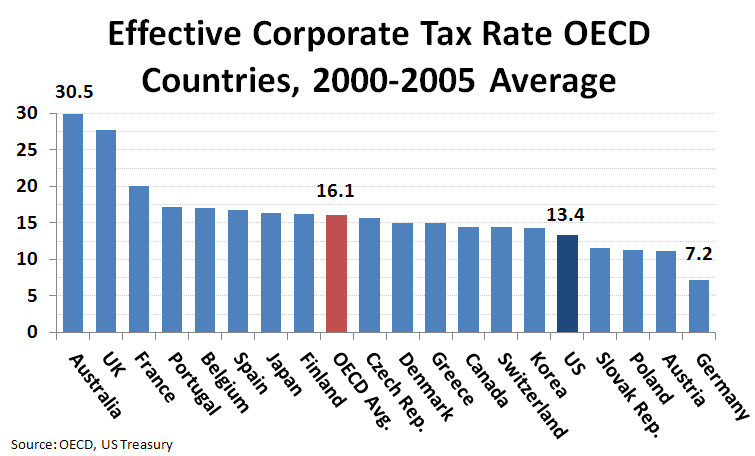

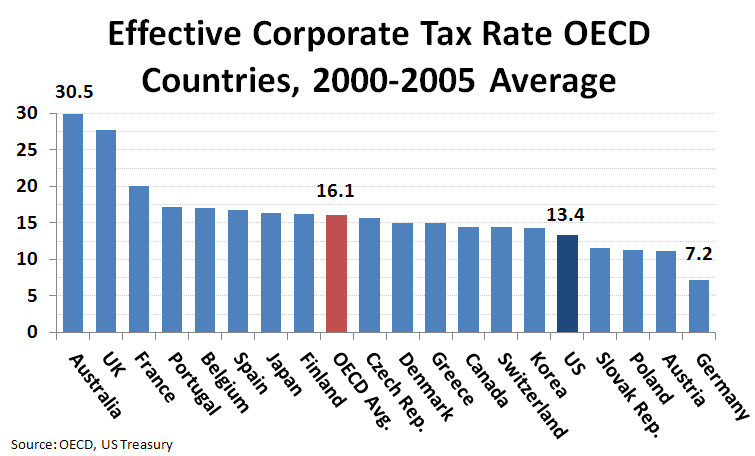

What's our effective corporate tax rate? 12-13%?

You can't really operate at at the level some of these other countries do when you run the war machine like we do, and have as many marginalized citizens you have to pay off like we do.

The effective rate is 35%. I'd love to see it at 12-13%.

It doesn't sound like you know what 'effective' means.

The effective corporate tax rate in the U.S. averages 12.6%.

http://money.cnn.com/2013/07/01/news/economy/corporate-tax-rate/

From the article you posted:

The federal corporate tax rate stands at 35%, and jumps to 39.2% when state rates are taken into account. But thanks to things like tax credits, exemptions and offshore tax havens, the actual tax burden of American companies is much lower.

So, tax credits, offshore tax havens (for the richer corporations) lower the effective tax rate. In other words, that money stays overseas and is not spent here. I'm sure that a lot of smaller companies that can't afford the tax credits, like the ones GE took to get a $0 tax bill due to their 'green energy' investments, would like to be able to cash in on those types of investments. If the tax rates were lower, let's say a 10% flat tax on all business, that money would come back to US shores, and it would be spent here.

![[Linked Image from s2.excoboard.com]](http://s2.excoboard.com/forums/25521/user/302752/484538.gif)

|

|

|

|

|

Joined: Mar 2013

Posts: 18,204

~ Legend

|

~ Legend

Joined: Mar 2013

Posts: 18,204 |

No it wouldn't. It would just cause a larger deficit. It would also make other countries lower their tax rates, because they want the money as well. Then you'll have to lower it again to beat the tax rates of other nations. It's just one big loop like that, and the American people are left out.

|

|

|

|

|

Joined: Sep 2006

Posts: 15,015

Legend

|

Legend

Joined: Sep 2006

Posts: 15,015 |

Quote:

Quote:

More so, everybody want better wages, but they also want cheaper goods.

Nothing like working at Chevy/Ford and then buying a Honda.

I own 2 of the most American made autos, both are Honda's...

https://autos.yahoo.com/photos/10-most-american-made-cars-1404166628-slideshow/

It wasn't an American versus foreign statement, as much as a "I want high wages to make your product for you, but have no intention of supporting you by buying said product."

We don't have to agree with each other, to respect each others opinion.

|

|

|

|

|

Joined: Sep 2006

Posts: 40,399

Legend

|

Legend

Joined: Sep 2006

Posts: 40,399 |

Quote:

No it wouldn't. It would just cause a larger deficit.

It would have to be larger than 10% but I would still prefer something much closer to a flat tax system that doesn't have 25,000 pages of exceptions and loopholes...

Quote:

It would also make other countries lower their tax rates, because they want the money as well. Then you'll have to lower it again to beat the tax rates of other nations. It's just one big loop like that, and the American people are left out.

That's competition.. Each country will do what is in their best interest.

yebat' Putin

|

|

|

|

|

Joined: Mar 2013

Posts: 18,204

~ Legend

|

~ Legend

Joined: Mar 2013

Posts: 18,204 |

Yes it is, but the people lose out during competition.

|

|

|

|

|

Joined: Sep 2006

Posts: 5,991

Hall of Famer

|

Hall of Famer

Joined: Sep 2006

Posts: 5,991 |

Quote:

Yes it is, but the people lose out during competition.

So what's your plan, we all make the same amount of money? People always lose out during competition. This isn't the 'everyone gets a trophy game'.

We lower taxes, corporations have more to spend for the best people in a country with some of the best infrastructure. The infrastructure will grow, the tax base will increase, and the money kept overseas will come home. Bring on the competition. The US will win.

|

|

|

|

|

Joined: Mar 2013

Posts: 18,204

~ Legend

|

~ Legend

Joined: Mar 2013

Posts: 18,204 |

"Lower tax rates will increase tax revenue."

That's some Reagan math right there.

|

|

|

|

|

Joined: Mar 2013

Posts: 18,204

~ Legend

|

~ Legend

Joined: Mar 2013

Posts: 18,204 |

Quote:

Quote:

Yes it is, but the people lose out during competition.

So what's your plan, we all make the same amount of money? People always lose out during competition. This isn't the 'everyone gets a trophy game'.

We lower taxes, corporations have more to spend for the best people in a country with some of the best infrastructure. The infrastructure will grow, the tax base will increase, and the money kept overseas will come home. Bring on the competition. The US will win.

If you want to really look at it, then Corporations will pay less in taxes, prices will remain the same, wages will remain the same and profits will continue to grow (Even though most companies are reporting record profits already) and stockholders will celebrate. There is no such thing as a "Trickle down economy". It doesn't exist at all. Reagan lied to you.

|

|

|

|

|

Joined: Sep 2006

Posts: 5,991

Hall of Famer

|

Hall of Famer

Joined: Sep 2006

Posts: 5,991 |

Quote:

No it wouldn't. It would just cause a larger deficit. It would also make other countries lower their tax rates, because they want the money as well. Then you'll have to lower it again to beat the tax rates of other nations. It's just one big loop like that, and the American people are left out.

Let's see. The corporate rate is lowered, and the American companies have more money to spend on their people for training, salaries, and other bennies, making the Americans the best workforce in the world. As we are such a large country, we have some of the best infrastructure, and most of America is still 'right to work', more companies will come here to keep from paying the high taxes in other countries. We shrink our bloated government, first by setting a flat tax rate on corporations, we make business easier in the US. Seems a win-win to me. As the tax base widens (meaning more corporations paying into the system), the deficit will shrink. More people employed means less government bennies being paid out, less need for those government employees.

![[Linked Image from s2.excoboard.com]](http://s2.excoboard.com/forums/25521/user/302752/484538.gif)

|

|

|

|

|

Joined: Sep 2006

Posts: 40,399

Legend

|

Legend

Joined: Sep 2006

Posts: 40,399 |

Quote:

Yes it is, but the people lose out during competition.

No, some people win and some people lose... this notion that we can find a sustainable scenario where everybody wins is a fallacy.

yebat' Putin

|

|

|

|

|

Joined: Sep 2006

Posts: 5,991

Hall of Famer

|

Hall of Famer

Joined: Sep 2006

Posts: 5,991 |

Quote:

There is no such thing as a "Trickle down economy". It doesn't exist at all. Reagan lied to you.

I can tell you from personal experience that I was much better off in the Reagan economy than the obama economy.

|

|

|

|

|

Joined: Sep 2006

Posts: 11,465

Legend

|

Legend

Joined: Sep 2006

Posts: 11,465 |

I don't think I understand what you're trying to say here. A few hours ago, you said you'd love it if the effective corporate tax rate was 12-13%. I pointed out that it was 12.6%. And you still find it problematic.

Also, it sounds as you if you believe that corporations have a loyalty to our country, and would rather stay here, but just can't because of taxes and regulations. That isn't the case.

In order to compete with the banana republics, we would have to turn ourselves into a banana republic, which as I said in the beginning, we simply cannot do.

It's way beyond taxes. We simply cannot offer what those countries can in terms of cheap labor and lax regulation.

Our effective corporate tax rate is already at 12.6%....and you think lowering it to 10% is going to bring companies back to America?

|

|

|

|

|

Joined: Mar 2013

Posts: 18,204

~ Legend

|

~ Legend

Joined: Mar 2013

Posts: 18,204 |

This system is based on the idea that A) other nations won't lower their tax rate and B) Corporations will leave C) Companies will suddenly turn into Oprah and just start giving people money instead of being Companies.

|

|

|

|

|

Joined: Mar 2013

Posts: 18,204

~ Legend

|

~ Legend

Joined: Mar 2013

Posts: 18,204 |

Quote:

Quote:

Yes it is, but the people lose out during competition.

No, some people win and some people lose... this notion that we can find a sustainable scenario where everybody wins is a fallacy.

I never said that. However, I think there is a solution where the American people win.

|

|

|

|

|

Joined: Sep 2006

Posts: 11,465

Legend

|

Legend

Joined: Sep 2006

Posts: 11,465 |

Quote:

Let's see. The corporate rate is lowered, and the American companies have more money to spend on their people for training, salaries, and other bennies, making the Americans the best workforce in the world.

You seriously believe this?

|

|

|

|

|

Joined: Sep 2006

Posts: 40,399

Legend

|

Legend

Joined: Sep 2006

Posts: 40,399 |

Quote:

However, I think there is a solution where the American people win.

I'm always up for hearing new ideas.. lay it out there.

yebat' Putin

|

|

|

|

|

Joined: Mar 2013

Posts: 18,204

~ Legend

|

~ Legend

Joined: Mar 2013

Posts: 18,204 |

I think we should give government contracts to corporations that don't go to countries like the Banana Republic or Ireland or any other country. That's just one idea.

|

|

|

|

|

Joined: Sep 2006

Posts: 5,991

Hall of Famer

|

Hall of Famer

Joined: Sep 2006

Posts: 5,991 |

I would suggest you search more sites than just CNN. You will see the effective tax rates are in the area of 30% for the US. The corporate tax rates are killing this country. The regulations are also killing this country.

If the tax rate was a flat tax, you simplify the entire system. Corporations will know exactly how much they will pay. This lessens the burden upon those corporations. More corporations will move to this country, or will incorporate within this country, which will increase competition between similar companies. This will increase wages, training, and infrastructure in this country, making it the best place to do business. We all win.

|

|

|

|

|

Joined: Mar 2013

Posts: 18,204

~ Legend

|

~ Legend

Joined: Mar 2013

Posts: 18,204 |

I have a question for you. How do you feel about China and Qatar? Do you feel like they're in a better position than the US? Do you feel like they're better run than the US? Would you like to see us emulate them?

|

|

|

|

|

Joined: Sep 2006

Posts: 5,991

Hall of Famer

|

Hall of Famer

Joined: Sep 2006

Posts: 5,991 |

Quote:

I have a question for you. How do you feel about China and Qatar? Do you feel like they're in a better position than the US? Do you feel like they're better run than the US? Would you like to see us emulate them?

I seem to remember someone telling me recently to not post items from Wikipedia websites. Have you checked where things lie since 2005? As for China and Qatar, they have a population of slave labor.

|

|

|

|

|

Joined: Jun 2010

Posts: 9,433

Hall of Famer

|

Hall of Famer

Joined: Jun 2010

Posts: 9,433 |

|

|

|

|

|

Joined: Jul 2014

Posts: 4,066

Hall of Famer

|

Hall of Famer

Joined: Jul 2014

Posts: 4,066 |

Quote:

I would suggest you search more sites than just CNN. You will see the effective tax rates are in the area of 30% for the US. The corporate tax rates are killing this country. The regulations are also killing this country.

If the tax rate was a flat tax, you simplify the entire system. Corporations will know exactly how much they will pay. This lessens the burden upon those corporations. More corporations will move to this country, or will incorporate within this country, which will increase competition between similar companies. This will increase wages, training, and infrastructure in this country, making it the best place to do business. We all win.

Not to mention by simplifying the tax code you can get rid of a lot of "loop holes" and regulations that only larger businesses can afford. This allows more people to get in to the game themselves.

What I have a hard time wrapping my head around is the people who complain the most about business being "evil" and too powerful. The only reason they are able to get that way is with the assistance of government creating exceptions or rules only they can afford, there by choking off any potential competition. And their solution? MORE rules, regulations, and gov't as if these news rules et al somehow won't benefit the same evil businesses! And the laughable part is that they then claim that the "free market" doesn't work.. as if a tightly controlled and gov't regulated economy is "free".

How about Obamacare as an example? It was presented as something that would make insurance companies accountable and force them to "do the right thing"... interesting how the law provides built in bail outs for them if they don't make any (or enough) money.

If the gov't is going to guarantee I never take a loss, why would I ever lower rates? Seems to me I'd have more incentive to raise them and make more $$ if I'll always get paid.

"Hey, I'm a reasonable guy. But I've just experienced some very unreasonable things."

-Jack Burton

-It looks like the Harvard Boys know what they are doing after all.

|

|

|

|

|

Joined: Sep 2006

Posts: 1,426

Dawg Talker

|

Dawg Talker

Joined: Sep 2006

Posts: 1,426 |

Quote:

Let's see. The corporate rate is lowered, and the American companies have more money to spend on their people for training, salaries, and other bennies, making the Americans the best workforce in the world.

This is where you lose me. I want to agree, but I think I've become too jaded/realistic since I've moved into the corporate world. Our profit margin for the company I worked for this year moved from 24% to 27%. That additional 3% of profit that was clawed away from low-wage employees did not go to training, "bennies" or anything else. It went into pockets of the upper crust of the company. I think it's idealistic to believe that the majority of companies would truly re-invest enough of that money to make it worthwhile.

[color:"green"] "World domination has encountered a momentary setback. Please talk amongst yourselves." Get Fuzzy[/color]

|

|

|

|

|

Joined: Sep 2006

Posts: 40,399

Legend

|

Legend

Joined: Sep 2006

Posts: 40,399 |

Sadly I would tend to agree with that.

yebat' Putin

|

|

|

|

|

Joined: Sep 2006

Posts: 11,465

Legend

|

Legend

Joined: Sep 2006

Posts: 11,465 |

The effective corporate tax rate is nowhere near what you claim it to be, and every time it's pointed out to you, you just ignore it and keep on.

I'm sorry, but the effective corporate tax rate is nowhere near 30-35%. It's less than half that.

Other than that, you're just describing trickle down economics.

|

|

|

|

|

Joined: Sep 2006

Posts: 7,380

Hall of Famer

|

Hall of Famer

Joined: Sep 2006

Posts: 7,380 |

Quote:

"Lower tax rates will increase tax revenue."

That's some Reagan math right there.

You might want to do a little research on that topic...you won't like what you'll learn.

|

|

|

|

|

Joined: Sep 2006

Posts: 40,399

Legend

|

Legend

Joined: Sep 2006

Posts: 40,399 |

Quote:

I think we should give government contracts to corporations that don't go to countries like the Banana Republic or Ireland or any other country. That's just one idea.

I can live with that...

yebat' Putin

|

|

|

|

|

Joined: Mar 2013

Posts: 18,204

~ Legend

|

~ Legend

Joined: Mar 2013

Posts: 18,204 |

Quote:

Quote:

"Lower tax rates will increase tax revenue."

That's some Reagan math right there.

You might want to do a little research on that topic...you won't like what you'll learn.

Here's some research for you:

http://www.factandmyth.com/taxes/tax-decreases-do-not-increase-revenue

It's a bunk idea flat out.

|

|

|

|

|

Joined: Sep 2006

Posts: 7,380

Hall of Famer

|

Hall of Famer

Joined: Sep 2006

Posts: 7,380 |

Bunk idea? Because of some website link biased towards its own agenda? Yeah...right.

You wouldn't believe what I would tell you about that issue...so we will have to agree to disagree.

I see the impact every single day in my business...you will believe what you wish.

|

|

|

|

|

Joined: Mar 2013

Posts: 919

All Pro

|

OP

All Pro

Joined: Mar 2013

Posts: 919 |

Big Business Spars Over Rewriting Tax Code The idea of overhauling the corporate-tax code is greeted with applause by nearly all U.S. big businesses. That unanimity breaks down once the conversation turns to details. According to a study by 24/7 Wall St. some of the largest U.S. public companies paid little or no taxes at all for 2012. MarketWatch's Jim Jelter discusses which companies made it on the list. (Photo: AP) One sign of that is the splintering of big companies into different groups promoting different strains of tax reform. High-tech, pharmaceutical and consumer-products companies, for instance, are eager to change the way overseas profits are taxed. Big domestic retailers, banks and telecommunications firms, in contrast, are more eager to see the corporate-tax rate come down. The fundamental tension reflects an arithmetic reality: Corporate-tax reform—even if it doesn't mean a net increase in taxes on business—means doing away with someone's tax break to pay for lowering the overall tax rate, now at 35%, though many companies pay less. There are winners, but there are also losers. "It's a total war, a war between the service sector and the manufacturing sector and the commodity sector," says Bill Bradley, the former Democratic senator from New Jersey, an architect of the 1986 Tax Reform Act. The tax-overhaul effort is underway in Congress but moving slowly. The House Ways and Means Committee, controlled by Republicans, is holding meetings on various aspects of rewriting the tax system. The Senate Finance Committee, controlled by Democrats, is doing the same. President Barack Obama has released a framework that calls for eliminating tax breaks to lower the corporate rate, but he hasn't offered specifics. The corporate tax is a big deal to the companies that pay it, but it represents a small slice of federal revenue, an estimated $251 billion for the current fiscal year ending Sept. 30, or 9.3% of federal revenue. The prospects for a major corporate-tax rewrite are clouded by partisan differences—and by the divisions in the business community. Washington has a plethora of business-lobby organizations already, but some of them represent such divergent business interests that they can't go much beyond endorsing the principle of tax reform. So new, tax-focused coalitions are emerging with logos, squads of lobbyists and PR people but, for the most part, without actual offices. At root, the different coalitions reflect the differences among big companies and across industries. Companies with huge capital investments, such as manufacturers, care a lot about the terms of writing them off; companies in labor-intensive business don't. Companies with big overseas profits focus heavily on how those earnings are taxed; primarily domestic companies don't. Companies who get little advantage from all the existing credits, deductions and loopholes are ready to sacrifice them to bring down the corporate-tax rate; those who benefit, not surprisingly, aren't. A dozen big high-tech, pharmaceutical and other companies that do business overseas recently formed a coalition called LIFT (for "Let's Invest for Tomorrow") America to press the U.S. to get rid its system of taxing companies' overseas profits while also lowering the corporate tax rate. LIFT has hired Claire Buchan Parker, who worked in the Reagan and both Bush administrations, to be its spokesperson. Members include Cisco Systems Inc., CSCO -1.21% Eli Lilly LLY +0.91% & Co. and Procter & Gamble Co. PG -0.06% America's world-wide taxation rules make the U.S. "an outlier," said Dave Cote, CEO of Honeywell International Inc., HON -0.35% a LIFT member. "It doesn't make any sense." Another group called RATE (for "Reforming America's Taxes Equitably") Coalition, organized more than a year ago, represents U.S.-focused companies pushing primarily for lower corporate-tax rates. It includes roughly 30 firms, most of them domestic-focused. Big names include AT&T Inc., T -0.12% Boeing Co. BA -2.33% , Ford Motor Co. F +0.48% and Walt Disney Co. DIS -0.14% "Corporate-tax reform done correctly—a materially lower rate competitive with the rest of the world, along with a simplified and broadened tax base—would provide stability, certainty and increased economic growth in the U.S., which in turn would contribute to reducing the deficit," said Maury Donahue, a spokesman for FedEx Corp. FDX -0.31% , a member of RATE. RATE, in the Washington tradition, is run by a bipartisan team— Elaine Kamarck, who worked for former Vice President Al Gore, and James Pinkerton, who worked for former President George H.W. Bush. Ms. Kamarck welcomed the enthusiasm for tax reform among other business groups. "We're just happy there are a lot of groups forming to talk about tax reform, because it's an indication that it's going to happen," she said. The differences between the RATE and LIFT groups reflect the tax situations of their members. Although the law sets a 35% tax rate—now highest among developed countries—the average company, after taking account of deductions and credits, actually paid about 26% in 2007 and 2008, the U.S. Treasury estimates. But that effective tax rate varies by industry: Mining firms face an average effective tax rate of 18% while wholesale and retail trade companies have an average rate of 31%. Martin Sullivan, chief economist of Tax Analysts, a nonprofit publisher, calculated last year that the members of RATE pay an average effective world-wide tax rate of about 32%. Lowering the statutory tax rate to 25%, as many firms want, would cost as much as $1 trillion over 10 years. Much of that amount would need to be offset by closing loopholes and eliminating deductions. Although LIFT also wants a lower rate, its focus is more on getting rid of the U.S. rules that seek to tax American firms on their world-wide profits. That change, already adopted by most developed countries, could cost the government $130 billion over 10 years, according to a blue-ribbon panel's estimate of one version of the idea. In essence, the groups are competing over a scarce resource—the revenue that would be raised by eliminating corporate tax breaks and loopholes. Some experts say corporate breaks are insufficient to lower the corporate rate to the 25% target, no matter how many are ended. So firms that favor a dramatically lower rate often don't want a portion of that revenue going to pay for a territorial system such as the one backed by LIFT. Yet another evolving coalition—as yet unnamed—includes tax officials from a mix of high-profile firms and has been working with the accounting firm PricewaterhouseCoopers as its technical consultant. Its membership is expected to include at least a dozen or so big companies, such as General Electric Co. GE -0.02% , P&G and Caterpillar Inc., CAT -1.22% and possibly more, according to people familiar with it. Its exact direction is unclear, but i has hired SKDKnickerbocker, a public-relations firm that includes Anita Dunn, a former top aide to President Obama. A few companies are in more than one camp. Intel Corp. INTC -1.22% , for instance, is working with all three. The Business Roundtable, a group of major-firm CEOs, has launched an advertising campaign to support both lower corporate-tax rates and a move to taxing only domestic profits. It has hired a high-profile bipartisan lobbying shop, Podesta Group, led by Democratic fundraiser Tony Podesta. The Roundtable's president, John Engler, a former Michigan governor, has said his organization will serve as an "umbrella" organization for the various coalitions. But in a hint of potential differences, LIFT sent representatives to the rollout of the Roundtable campaign, but the RATE coalition didn't. A RATE spokesman said the group is "happy to work with everyone toward a common goal on this." And then there are the U.S. businesses—some small, some very large— that are organized in ways that largely avoid the corporate tax. They pay tax on their profits through their owners' returns at individual income rates. These firms have grown more numerous over the past couple decades and now account for roughly half of all business profits. They worry they could become the cash cow that finances a tax rewrite for traditional corporations. Private-equity firm Blackstone Group BX +0.73% LP, construction outfit Bechtel Group Inc. and pipeline firm Kinder Morgan are among the better-known firms that have organized in ways that largely avoid the corporate tax. Relaxations in some tax rules and easier access to capital have helped fuel the trend of large firms organizing as small businesses or partnerships. The proliferation of such firms "makes it much, much harder" for Congress to reach a tax-overhaul deal, said Michael Graetz, a Columbia University law professor and former top Treasury tax officialhttp://online.wsj.com/news/articles/SB10001424127887323361804578388112619484392.

GO BROWNS!

|

|

|

|

|

Joined: Mar 2013

Posts: 14,754

Legend

|

Legend

Joined: Mar 2013

Posts: 14,754 |

Personally I think George W Bush was the worst president. 9/11.... Iraq war.... No bid contracts. That's enough.

I have the feeling Dick Cheney was actually pulling the strings back then, but that's another story.

|

|

|

|

|

Joined: Sep 2006

Posts: 78,579

Legend

|

Legend

Joined: Sep 2006

Posts: 78,579 |

I think where a lot of confusion lies is what the rate is, compared to what percentage is actually paid after all of the tax loopholes and deductions come into play. I'm quite sure those two figures are nowhere close to the same. Here are some examples........ 26 top American corporations paid no federal income tax from ’08 to ’12 – report http://rt.com/usa/low-corporate-tax-rates-275/Of course, many corporations are so adept at manipulating the tax code that they pay no federal taxes at all. According to Citizens for Tax Justice, a progressive group, 78 companies paid no federal income taxes at least one year between 2008 and 2010. The data come from annual company reports and may not necessarily reflect actual tax payments on tax returns because of different accounting concepts. Earlier this year, the Government Accountability Office, a federal agency, examined corporate tax returns to determine the taxes corporations actually pay. It found that in 2010, profitable corporations based in the United States had an effective federal tax rate of 13 percent on their worldwide income, 17 percent including state and local taxes. http://economix.blogs.nytimes.com/2013/1...=blogs&_r=0Many Fortune 500 Firms Pay Less in Income Taxes Than You A recent study examined 280 of the largest companies in America and the taxes they paid in 2008, 2009, and 2010. All were Fortune 500 companies. And all were profitable. In fact, their pre-tax profit over that period totaled $1.4 trillion. Yet a whopping 25% of them paid federal taxes at a rate of less than 10% (compared to the standard 35% corporate tax rate). And 30 of these companies paid absolutely no income tax on their profits between 2008 and 2010. The 78 companies that enjoyed at least one year of paying no income tax had profits equaling $156 billion. Yet instead of the $55 billion in tax revenue you'd assume the government would have received (at the 35% corporate rate), these companies (all of which -- again -- were profitable) received refund checks from the government totaling $21.8 billion. We're talking corporate giants ranging from Duke Energy and Eli Lilly to ExxonMobil and Goldman Sachs. http://www.dailyfinance.com/2012/05/07/many-fortune-500-firms-pay-less-in-income-taxes-than-you/I believe that quoting what the tax rate is and not showing what tax rate was actually paid in paints a false picture.

Intoducing for The Cleveland Browns, Quarterback Deshawn "The Predator" Watson. He will also be the one to choose your next head coach.

#gmstrong

|

|

|

|

|

Joined: Sep 2006

Posts: 11,878

Legend

|

Legend

Joined: Sep 2006

Posts: 11,878 |

Quote:

9/11

I thought he was horrible, but I'm curious as to see why it seems you have associated 9/11 as one of his flaws...

Blue ostriches on crack float on milkshakes between the sidewalk titans of gurglefitz. --YTown

#gmstrong

|

|

|

|

|

Joined: Mar 2013

Posts: 14,754

Legend

|

Legend

Joined: Mar 2013

Posts: 14,754 |

Quote:

Quote:

9/11

I thought he was horrible, but I'm curious as to see why it seems you have associated 9/11 as one of his flaws...

Because it happened while he was president and he said he had no prior knowledge that that was being planned, even though if you do some research he definitely know. I myself read about another possible terrorist attack a month or two before 9/11 in the Plain Dealer newspaper. If I knew, he had to of known.

'Bush Warned of Hijackings Before 9-11'

http://abcnews.go.com/US/story?id=91651

I think 9/11 was something that was allowed to happen so our government would have a reason to monitor everything we do (phone calls, emails, etc.) under the guise of terrorism. I also think this was all a prelude to our coming one world government, New World Order. But I'm a conspiracy theorist of sorts.

I don't know if I'd go as far to say there were explosives placed in the World Trade Centers, but some people do believe that. I don't know about that.

|

|

|

|

|

Joined: Sep 2006

Posts: 5,991

Hall of Famer

|

Hall of Famer

Joined: Sep 2006

Posts: 5,991 |

Quote:

Quote:

Let's see. The corporate rate is lowered, and the American companies have more money to spend on their people for training, salaries, and other bennies, making the Americans the best workforce in the world.

This is where you lose me. I want to agree, but I think I've become too jaded/realistic since I've moved into the corporate world. Our profit margin for the company I worked for this year moved from 24% to 27%. That additional 3% of profit that was clawed away from low-wage employees did not go to training, "bennies" or anything else. It went into pockets of the upper crust of the company. I think it's idealistic to believe that the majority of companies would truly re-invest enough of that money to make it worthwhile.

It makes me wonder if it goes into regulations. Sarbanes/Oxley comes to mind. It sucks up a lot of corporate profit having to pay workers, administrators, and managers to satisfy a government regulation that was brought on due to a few crooked companies. I can understand corporate regulations, like PCI certifications or ISO certifications, but the government ones are punishment for a few bad companies.

![[Linked Image from s2.excoboard.com]](http://s2.excoboard.com/forums/25521/user/302752/484538.gif)

|

|

|

|

|

Joined: Sep 2006

Posts: 28,339

Legend

|

Legend

Joined: Sep 2006

Posts: 28,339 |

Quote:

I think 9/11 was something that was allowed to happen so our government would have a reason to monitor everything we do (phone calls, emails, etc.) under the guise of terrorism. I also think this was all a prelude to our coming one world government, New World Order. But I'm a conspiracy theorist of sorts.

It isn't that far-fetched.at all.

The plan to create Homeland Security came about VERY quickly on the heels of 9/11, so quickly that one might be inclined to think that it was already thought out and in the can, just waiting to be pulled out.

There was, and is, no actual need for Homeland Security (just as there is no need for TSA, but I digress).... they just needed to actually have the existing departments actually communicate with each other.

Browns is the Browns

... there goes Joe Thomas, the best there ever was in this game.

|

|

|

|

|

Joined: Sep 2006

Posts: 78,579

Legend

|

Legend

Joined: Sep 2006

Posts: 78,579 |

It did seem like a very convenient package ready to roll out.

Homeland Security and The Patriot Act.

Larger, far more intrusive government very quickly. Fear is a motivating factor for people to accept things they would normally never consider.

Intoducing for The Cleveland Browns, Quarterback Deshawn "The Predator" Watson. He will also be the one to choose your next head coach.

#gmstrong

|

|

|

|

|

Joined: Sep 2006

Posts: 28,339

Legend

|

Legend

Joined: Sep 2006

Posts: 28,339 |

Yup, and it was VERY quick in the way it rolled and was shoved through.

Browns is the Browns

... there goes Joe Thomas, the best there ever was in this game.

|

|

|

|

|

Joined: Sep 2006

Posts: 50,821

Legend

|

Legend

Joined: Sep 2006

Posts: 50,821 |

Quote:

A recent study examined 280 of the largest companies in America and the taxes they paid in 2008, 2009, and 2010. All were Fortune 500 companies. And all were profitable. In fact, their pre-tax profit over that period totaled $1.4 trillion.

I don't know the circumstances, but I would assume that some larger companies wrote off a lot of losses from other years in those down years.

Further, some larger companies, like GE, for example, got massive (and refundable) tax credits for pursuing alternative energy projects.

Businesses are allowed to write off depreciation, and losses, and investments, and so on. These factors do help bring down the effective rate of taxation. Many times certain industries receive certain beneficial tax incentives. I believe that all 3 of the Big 3 Auto manufacturers received credits for alternative energy projects as well. Many factors wind up involved in the end result, and they come from both sides of the aisle.

Micah 6:8; He has shown you, O mortal, what is good. And what does the Lord require of you? To act justly and to love mercy, and to walk humbly with your God.

John 14:19 Jesus said: Because I live, you also will live.

|

|

|

|

|

Joined: Sep 2006

Posts: 11,465

Legend

|

Legend

Joined: Sep 2006

Posts: 11,465 |

Quote:

Quote:

Quote:

Let's see. The corporate rate is lowered, and the American companies have more money to spend on their people for training, salaries, and other bennies, making the Americans the best workforce in the world.

This is where you lose me. I want to agree, but I think I've become too jaded/realistic since I've moved into the corporate world. Our profit margin for the company I worked for this year moved from 24% to 27%. That additional 3% of profit that was clawed away from low-wage employees did not go to training, "bennies" or anything else. It went into pockets of the upper crust of the company. I think it's idealistic to believe that the majority of companies would truly re-invest enough of that money to make it worthwhile.

It makes me wonder if it goes into regulations. Sarbanes/Oxley comes to mind. It sucks up a lot of corporate profit having to pay workers, administrators, and managers to satisfy a government regulation that was brought on due to a few crooked companies. I can understand corporate regulations, like PCI certifications or ISO certifications, but the government ones are punishment for a few bad companies.

A few bad apples, huh?

No offense, but your posts read like the most simplistic A.M. radio host rants.

They read as if corporations are trying to be fair and just, but they're just held back by regulations, and are forced to pass along the costs in order to make a profit.

The truth is, they have no allegiance whatsoever to our country.

If you make the corporate tax rate 0%, they'll leave for a place that pays them to come.

If you make the minimum wage $3 an hour, they'll go where it's $1.

Their motive is maximum profit. No allegiance. No hometown discount. Nothing we can do is going to 'bring them back', unless we want to lower ourselves to the living conditions of third world hellholes.

Businesses aren't leaving because of the tax rate. They're leaving because they can pay a brown kid 35 cents a day at 100 hours a week and churn out all the smog the stacks can choke out. In lesser extremes, they're going places with minimal expansion, where they can operate without legislation or regulation.

We cannot compete with that, nor should we.

There's not much we can do in that regard. But pretending that we can woo them back certainly won't help. They don't care when they lay off you or I or cripple a town in Indiana. They. Do. Not. Care. And lowering the 0-12% corporate tax rate they pay won't change that.

We fell in love with a whore, and now we have to suffer the consequences of that.

Stop parroting the propaganda you hear and read.

We could completely eliminate the corporate tax rate tomorrow, and they're not coming back, and they're still leaving.

As a side note, and not directed at you...ever notice that the people who advocate free market capitalism are the first people to cry foul when they get the slightest taste of it?

Next time you hear someone whining about illegal immigrants, or jobs going overseas...ask them about the free market. High odds they'll champion it, and talk about how if the government just got out of the way, we'd be all good.

|

|

|

DawgTalkers.net

Forums DawgTalk Everything Else... Is Obama the Worst President?

|

|