|

|

Joined: Sep 2017

Posts: 8,974

Hall of Famer

|

Hall of Famer

Joined: Sep 2017

Posts: 8,974 |

this is going to be under the new tax code.

|

|

|

|

|

Joined: Nov 2006

Posts: 3,259

Hall of Famer

|

Hall of Famer

Joined: Nov 2006

Posts: 3,259 |

You missed what I was saying. Completely. The code that allows states to write off local and state taxes is the problem. The top 7 states with the highest taxes in state and local deductions, receive 50% of the total value of deductions. With that code being repealed, those people are now going to see their taxes increase significantly, thus forcing a change in local and state taxes. You see, those 7 states are blue states. So the rest of the country is subsidizing their deductions. Oh no, I read that. I just didn't believe what I read and gave you the benefit of the doubt. What it appears to me that I'm reading is that you're OK with raising the taxes on middle class Americans, whether in red states or blue as long as it hurts people in blue states. I do agree with you that the rhetoric from NY and California lawmakers has been fierce on this, but Pennsylvania, Texas, and Ohio were in the top 10 on deducting state and local taxes in 2014. I don't consider Texas a blue state. Do you?

#gmstrong

|

|

|

|

|

Joined: Nov 2006

Posts: 3,259

Hall of Famer

|

Hall of Famer

Joined: Nov 2006

Posts: 3,259 |

this is going to be under the new tax code. True, and I think a 46% top rate is in line with other western countries. Anyone making over a million dollars a year in income is almost assuredly going to be either a business owner/partner and therefore can keep the profits in the business and taxed at 25% until such time they want to draw down under the new plan, OR they are the CEO of a company in which case you talk to your CFO down the hall and have them adjust your income and bring in perks like a company car (or two), a stipend, stock options, etc.

Last edited by gage; 11/03/17 02:52 PM.

#gmstrong

|

|

|

|

|

Joined: Oct 2017

Posts: 3,946

Hall of Famer

|

Hall of Famer

Joined: Oct 2017

Posts: 3,946 |

this is going to be under the new tax code. And my point will still stand - if you're clearing a million and paying 46% you need to fire the person preparing your taxes. This is discussing a base and not effective level. It discounts deductions or exemptions, assumes all income is personal and not under an LLC, where even more exemptions and deductions are available, it assumes earnings and holdings are U.S. based. Just from my own personal life - my best income years sees a lot of residual checks from episodes rerun in network or syndication. There are many loopholes available where most if not all of that money isn't taxed, and still wouldn't be under this after-tax cap. If you have a production company, there's even more loopholes, exemptions and deductions You only pay as much as the deductions, loopholes and exemptions you can find, and the more money you make, the more there are.

|

|

|

|

|

Joined: Sep 2017

Posts: 8,974

Hall of Famer

|

Hall of Famer

Joined: Sep 2017

Posts: 8,974 |

You missed what I was saying. Completely. The code that allows states to write off local and state taxes is the problem. The top 7 states with the highest taxes in state and local deductions, receive 50% of the total value of deductions. With that code being repealed, those people are now going to see their taxes increase significantly, thus forcing a change in local and state taxes. You see, those 7 states are blue states. So the rest of the country is subsidizing their deductions. Oh no, I read that. I just didn't believe what I read and gave you the benefit of the doubt. What it appears to me that I'm reading is that you're OK with raising the taxes on middle class Americans, whether in red states or blue as long as it hurts people in blue states. I do agree with you that the rhetoric from NY and California lawmakers has been fierce on this, but Pennsylvania, Texas, and Ohio were in the top 10 on deducting state and local taxes in 2014. I don't consider Texas a blue state. Do you? i am ok with those states paying their share of taxes. the rich do not need that deduction. if think the middle class is going to be hurt by not having that deduction, i refer you to your local and state government to inform them that your taxes and policies are hurting the middle class. There is no need for a deduction, if the tax is not obscene.

|

|

|

|

|

Joined: Sep 2017

Posts: 8,974

Hall of Famer

|

Hall of Famer

Joined: Sep 2017

Posts: 8,974 |

if you want to live in those states, i shouldn't be paying for your deduction. if you’re gonna elect these kinds of people, that implement those state and local taxes, if you’re gonna elect people that do nothing but raise taxes on you and spend you into debt, Live with it. its not my job to pay for your deduction.

|

|

|

|

|

Joined: Dec 2014

Posts: 25,823

Legend

|

Legend

Joined: Dec 2014

Posts: 25,823 |

If your state and local taxes are so high that losing the ability to deduct them is a killer, it is time for you to take responsibility and elect new state and local leaders.

|

|

|

|

|

Joined: Sep 2017

Posts: 8,974

Hall of Famer

|

Hall of Famer

Joined: Sep 2017

Posts: 8,974 |

seems like we need to have tax reform to close those loopholes then , no?

|

|

|

|

|

Joined: Sep 2017

Posts: 8,974

Hall of Famer

|

Hall of Famer

Joined: Sep 2017

Posts: 8,974 |

If your state and local taxes are so high that losing the ability to deduct them is a killer, it is time for you to take responsibility and elect new state and local leaders. you deserve the government you elect...doesn't spiral say that all the time.......you elect more taxes, you shouldn't get a break form those taxes at the expense of the poor and middle class.

|

|

|

|

|

Joined: Oct 2017

Posts: 3,946

Hall of Famer

|

Hall of Famer

Joined: Oct 2017

Posts: 3,946 |

seems like we need to have tax reform to close those loopholes then , no? Tell that to Paul Ryan and President Dementia. Not that it's an issue solely on the GOP, but they're the ones with the monopoly who keep feverishly enacting them (with the exception of wind and solar energy, which Trump just eliminated loopholes and raised taxes on for the dual reasons of 1) he has an aesthetic dislike of wind turbines - he finds them ugly and 2) his usual diaper filling over being less popular than Obama, which often manifests itself in dismantling things for no reason but hissy fit spite.

|

|

|

|

|

Joined: Oct 2017

Posts: 3,946

Hall of Famer

|

Hall of Famer

Joined: Oct 2017

Posts: 3,946 |

And, obviously, 3) they're all at the whim of the oil industry, but that's more the guiding hand of other players. Trump brain doesn't operate at a level beyond knee-jerk reactionary. He more or less thinks all the people he sits down with are good people, so long as they speak highly of him. If Kim Jong-Un praised him, Trump would love him. EDIT: I completely forgot Trump already did this. Jong-Un called Trump a leader, so Trump blathered on about how smart Jong-Un was. http://www.bbc.com/news/world-asia-39764834

Last edited by PDF; 11/03/17 03:30 PM.

|

|

|

|

|

Joined: Sep 2006

Posts: 15,171

Legend

|

Legend

Joined: Sep 2006

Posts: 15,171 |

j/c Found this Forbes piece in my fb feed: The House Tax Bill: Six Popular Breaks You Didn't Realize You'll Be LosingTony Nitti , CONTRIBUTOR Earlier today, the House of Representatives released its vision of tax reform, and there's a lot to digest. Over 420 pages, in fact. Luckily, there has been no shortage of quality coverage of the bill around the internet, detailing the changes to tax rates and personal exemptions and the like. But with 420 pages, some things are sure to slip through the cracks, and it is to these less publicized items that this column intends to draw attention. Of course, there are both unexpected tax breaks and increases hidden within the bowels of the bill, but lest you forget, I'm generally a miserable person who prefers to dwell on the negative. As a result, let's take a look at six tax breaks that you very likely didn't realize you will lose if today's bill becomes law. #1: Divorce just got even more expensive. Under current law, alimony payments are deductible by the payor, and considered taxable income to the payee. And because you people are simply incapable of remaining faithful, there is a lot of alimony paid each year, about $10 billion to be exact. The House bill eliminated the deduction for alimony. The change doesn't add much revenue, however, because the bill also makes alimony tax-free to the recipient. As a result, it raises only $8 billion over ten years, almost entirely from Larry King. #2: Don't be in a rush to sell your house. When you sell your home, provided you have owned and used the home as your primary residence for two of the prior five years, you may exclude up to $500,000 of the gain (if married, $250,000 if single). The House bill would require that, in order to exclude the gain from a sale, you own and use the house as your primary residence for five of the prior eight years. In addition, you begin to lose the exemption as adjusted gross income (in a look-back period) exceeds $500,000 (if married, $250,000 if single). #3: Don't get sick. Or move. Or go back to school. Or do anything, really. Taxpayers may deduct medical expenses incurred to mitigate, diagnose, treat a disease. Today's bill would eliminate the deduction for all medical expenses. This will prove particularly damaging to the elderly, many of whom have traditionally relied on the deduction for a portion of their nursing home care to wipe out any income they use to pay those expenses. In addition, if you have to move for a new job, you generally may deduct the cost to transport your belongings to your new home. Generally, your new gig must be at least 50 miles farther from your old house than your old gig. In other words, your commute, had you not moved, would have grown by 50 miles. Today's bill will eliminate the moving deduction. But don't let a lost tax deduction motivate you to hire a low-budget moving company. My wife and I tried that once and ended up engaging the services of what I can only assume was the Russian mob. Needless to say, things did not go well, at least until I paid three grand to get my stuff out of a storage locker in Kansas. Finally, if you're an employee who was thinking of going back to school for a graduate degree in your particular business field, you may want to think twice. Under current law, your employer can pay up to $5,250 of your tuition, books, etc. . . and you don't have to recognize the payment as income. Alternatively, if your employer won't pay for you to go to school, you may deduct any unreimbursed educational expenses, provided the education simply maintains or improves your existing skills, and doesn't prepare or qualify you for a new trade or business. Today's bill would eliminate BOTH the ability to receive tax-free educational assistance from your employer and the unreimbursed employee expense for professional education. So if the employer pays, you're recognizing taxable income, and if you pay, you get no deduction. I guess it makes sense for the GOP to discourage education; after all, if the country wises up, what happens to Fox News? HI-YO! #4: Every day will be "Bring your kid to work day!" Similar to educational assistance, an employer may pay directly or reimburse up to $5,000 for an employee's dependent care expenses, without the employee having to recognize the income. This allows the employee to seek care for a child under 13 on a tax-free basis. Well, get ready to spend considerably more quality time with Junior, because today's bill would eliminate the exclusion. As a result, any amount the employer pays on your behalf or reimburses you is taxable income. #5: You didn't think it was possible, but somehow your student loans just became a BIGGER hassle. Taxpayers can deduct -- up to certain limits -- the interest paid on student loans. Even better, the deduction is not an itemized deduction, so every taxpayer is eligible, though the deductions do disappear as income exceeds fairly moderate thresholds. The House bill would eliminate the deduction for student loan interest, leaving you without even a tax benefit to show for that ill-advised philosophy degree. #6: Time to fire your tax preparer (note: do not fire your tax preparer). Nobody likes their tax preparer. Trust me, I know. I'm one of them AND I'm surrounded by them all day. We're the worst. But at least in the past, you could stomach your interactions with people like me because you knew that every penny you paid me was tax-deductible. Well, no more...the House bill eliminates the deduction for tax prep fees. But don't let that discourage you from offering up a healthy tip. I've got kids to feed.

"too many notes, not enough music-"

#GMStong

|

|

|

|

|

Joined: Oct 2017

Posts: 3,946

Hall of Famer

|

Hall of Famer

Joined: Oct 2017

Posts: 3,946 |

I'm surprised that the adoption tax credit didn't make this list.

Which, by the way, is another in a long line of examples showing that these people couldn't care less about abortion, aren't pro-life, and are just using it as a wedge issue to pull votes.

|

|

|

|

|

Joined: Sep 2006

Posts: 15,171

Legend

|

Legend

Joined: Sep 2006

Posts: 15,171 |

I'll see if I can find the news item/article/podcast/interview about the origins of the abortion 'issue'. It was a real eye-opener.

"too many notes, not enough music-"

#GMStong

|

|

|

|

|

Joined: Nov 2006

Posts: 3,259

Hall of Famer

|

Hall of Famer

Joined: Nov 2006

Posts: 3,259 |

i am ok with those states paying their share of taxes. the rich do not need that deduction. if think the middle class is going to be hurt by not having that deduction, i refer you to your local and state government to inform them that your taxes and policies are hurting the middle class. There is no need for a deduction, if the tax is not obscene. you deserve the government you elect...doesn't spiral say that all the time.......you elect more taxes, you shouldn't get a break form those taxes at the expense of the poor and middle class. I live in Ohio which as I mentioned above was top 10 in taking the local and state deduction in 2014. I itemize my taxes as a business owner because well, businesses require capital as you know. I have brought 5 jobs to the state. Not huge numbers but 4 of the employees were out of state that I had moved here, and they are high paying software jobs. I tilt pretty damn conservative fiscally. The Ohio house, senate, and governor are Republican. My US House rep is Jim Renacci (R), One of my Senators is Rob Portman (R), and the US House Ohio Reps are mostly Republican. Please stop spewing talking points that I deserve the government I elect. I don't live in California. The reigning party of Ohio is supposed to be the party of small government, and fiscal conservatism and lower taxes. As far as I have seen, there isn't a fiscally conservative party at the federal level right now. As a SBO in the midwest this tax plan hurts me, not helps me. The deduction removals hurt and the passthrough tax rate doesn't look like it will work for service businesses such as mine. It also seems like you (and others?) are happy about this situation. Which I also admit I don't understand. I'm not looking to start anything here, just giving you my impression.

#gmstrong

|

|

|

|

|

Joined: Oct 2017

Posts: 3,946

Hall of Famer

|

Hall of Famer

Joined: Oct 2017

Posts: 3,946 |

It also seems like you (and others?) are happy about this situation. Which I also admit I don't understand. A lot of things have come down to a non-empathetic zero sum game of political football and cheap points. A clear of example of this was when the GOP's health care repeal efforts turned out to be a massive screw turned into the working class and elderly or those in rural/Rust Belt areas that voted red, there was a sentiment of near glee in certain liberal circles. A 'haha'-thumbing of the nose because these people got some kind of karma for voting against their interests. Those sentiments make it very hard to suppose a good faith argument. The message should be that these people deserve health care treatment, not spiking a football because they made a poor voting decision. Grievance, resentment and schaudenfreude have become a major part of our political process and how it carries itself out.

|

|

|

|

|

Joined: Oct 2017

Posts: 3,946

Hall of Famer

|

Hall of Famer

Joined: Oct 2017

Posts: 3,946 |

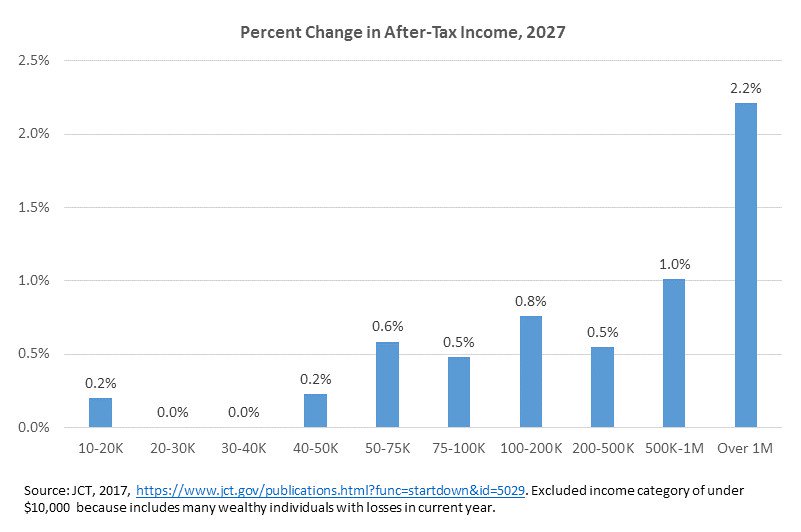

After-tax income determined by reverse engineering off average tax rates. These are in percentage terms, and do not include the estate tax being killed. This is going to hurt so many people in the name of giving rich people more money. "An average savings of $4,000."

|

|

|

|

|

Joined: Mar 2013

Posts: 52,481

Legend

|

OP

Legend

Joined: Mar 2013

Posts: 52,481 |

They need their yachts in a timely manner, bro.

“To announce that there must be no criticism of the President, or that we are to stand by the President, right or wrong, is not only unpatriotic and servile, but is morally treasonable to the American public.”

- Theodore Roosevelt

|

|

|

|

|

Joined: Sep 2006

Posts: 27,719

Legend

|

Legend

Joined: Sep 2006

Posts: 27,719 |

Taxpayers may deduct medical expenses incurred to mitigate, diagnose, treat a disease. Today's bill would eliminate the deduction for all medical expenses. This will prove particularly damaging to the elderly, many of whom have traditionally relied on the deduction for a portion of their nursing home care to wipe out any income they use to pay those expenses.

this one alone would kill me this year as I will be looking at over 10 K in medical expenses this year, and if things don't change around 20,000 in 2018.

I AM ALWAYS RIGHT... except when I am wrong.

|

|

|

|

|

Joined: Oct 2017

Posts: 3,946

Hall of Famer

|

Hall of Famer

Joined: Oct 2017

Posts: 3,946 |

I'm hoping to see something similar to the proposed health care bill, where people saw how awful it was and made enough calls that it became too dangerous to vote yes on.

We're seeing a shift in the population actually looking into details of bills, and picking up the phone to call their reps and senators. Sadly, I think this direct action is the result of so many people struggling and hurting financially that they're forced to pay keen attention to matters of health care and finance.

|

|

|

|

|

Joined: Sep 2006

Posts: 27,719

Legend

|

Legend

Joined: Sep 2006

Posts: 27,719 |

If your state and local taxes are so high that losing the ability to deduct them is a killer, it is time for you to take responsibility and elect new state and local leaders. If your poor and or sick and your FEDERAL Government bends you over and raises your taxes it's time to vote THEM out of office

I AM ALWAYS RIGHT... except when I am wrong.

|

|

|

|

|

Joined: Sep 2006

Posts: 27,719

Legend

|

Legend

Joined: Sep 2006

Posts: 27,719 |

I'm hoping to see something similar to the proposed health care bill, where people saw how awful it was and made enough calls that it became too dangerous to vote yes on. If your a member of AARP you already will know who to complain to write or call as they send you emails with the info you need. There is nothing scarier than a bunch of us old folks upset and flinging around our dirty depends.

I AM ALWAYS RIGHT... except when I am wrong.

|

|

|

|

|

Joined: Sep 2006

Posts: 27,719

Legend

|

Legend

Joined: Sep 2006

Posts: 27,719 |

I'm surprised that the adoption tax credit didn't make this list.

Which, by the way, is another in a long line of examples showing that these people couldn't care less about abortion, aren't pro-life, and are just using it as a wedge issue to pull votes. Yes this tax change will do away with the adoption credit.  As far as abortion... well has anybody read this part of the TAX bill? Unborn children count, too: The tax bill's language on the tuition-savings plans had social critics take notice for reasons not entirely related to education. What was unusual was this language: "Unborn children allowed as account beneficiaries." This means a mother expecting a child could set up a 529 plan for college or K-12 use. The bill even defines "unborn" as a "child in utero," which it then defines as "a member of the species homo sapiens, at any stage of development, who is carried in the womb.'' This leaves no doubt as to the meaning. But abortion rights activists see it as about much more than education. The language inserts the concept of "personhood," they say, a way to give rights to a fetus in a longer-range drive to restrict or outlaw abortion. That and the Business tax cuts I like.

I AM ALWAYS RIGHT... except when I am wrong.

|

|

|

|

|

Joined: Sep 2006

Posts: 4,480

Hall of Famer

|

Hall of Famer

Joined: Sep 2006

Posts: 4,480 |

As a SBO in the midwest this tax plan hurts me, not helps me. The deduction removals hurt and the passthrough tax rate doesn't look like it will work for service businesses such as mine. It also seems like you (and others?) are happy about this situation. Which I also admit I don't understand. I'm not looking to start anything here, just giving you my impression.

I haven't had a chance to deep dive the bill yet, but curious as to why you think that service industries won't benefit/be eligible for the 25% rate? I haven't, at the high level articles I've read, seen where certain businesses were exempted.

#gmstrong

|

|

|

|

|

Joined: Dec 2014

Posts: 25,823

Legend

|

Legend

Joined: Dec 2014

Posts: 25,823 |

If your state and local taxes are so high that losing the ability to deduct them is a killer, it is time for you to take responsibility and elect new state and local leaders. If your poor and or sick and your FEDERAL Government bends you over and raises your taxes it's time to vote THEM out of office  As is our Right.

|

|

|

|

|

Joined: Oct 2017

Posts: 3,946

Hall of Famer

|

Hall of Famer

Joined: Oct 2017

Posts: 3,946 |

I'm surprised that the adoption tax credit didn't make this list.

Which, by the way, is another in a long line of examples showing that these people couldn't care less about abortion, aren't pro-life, and are just using it as a wedge issue to pull votes. Yes this tax change will do away with the adoption credit.  As far as abortion... well has anybody read this part of the TAX bill? Unborn children count, too: The tax bill's language on the tuition-savings plans had social critics take notice for reasons not entirely related to education. What was unusual was this language: "Unborn children allowed as account beneficiaries." This means a mother expecting a child could set up a 529 plan for college or K-12 use. The bill even defines "unborn" as a "child in utero," which it then defines as "a member of the species homo sapiens, at any stage of development, who is carried in the womb.'' This leaves no doubt as to the meaning. But abortion rights activists see it as about much more than education. The language inserts the concept of "personhood," they say, a way to give rights to a fetus in a longer-range drive to restrict or outlaw abortion. That and the Business tax cuts I like. Without getting into debate on abortion, just looking at their actions - Don't you think this is a deliberately and specifically placed bone to appeal to people in line with your views? I mean...they're cutting the adoption credit, they want to slash funds available for medical care for expectant or new mothers, they want to promote 'abstinence only' education, which has been proven over and over and over to increase unwanted and/or youth pregnancy. I understand that they provide the best option for your worldview, but at what point do you think "I think they might be just appealing to that for my vote, and won't actually do anything about it?" Their most recent token gesture was to produce a bill that would ban abortions that happen before six weeks of pregnancy. Hell, a lot of women don't even know they're pregnant at six weeks. It's not a serious bill. It's a way to throw a token bone, knowing that it won't have any impact to get them canned.

|

|

|

|

|

Joined: Sep 2006

Posts: 27,719

Legend

|

Legend

Joined: Sep 2006

Posts: 27,719 |

Y'all know my views on the subject, BUT it has no business even being mentioned in a tax bill. Also doing away with the adoption credit is asinine.

I AM ALWAYS RIGHT... except when I am wrong.

|

|

|

|

|

Joined: Mar 2013

Posts: 52,481

Legend

|

OP

Legend

Joined: Mar 2013

Posts: 52,481 |

lmfao. you conservatives i swear. Republicans Sneak Anti-Abortion Language Into Tax Bill https://www.yahoo.com/news/republicans-sneak-anti-abortion-language-190434760.htmlRepublicans slipped anti-abortion language into the draft of the tax reform bill they released on Thursday. The move is part of an effort by the Trump administration and House Republicans to define life as beginning at conception, with an eye to rolling back Roe v. Wade. Buried on page 93 of the 429-page tax proposal is a provision that would allow fetuses to be named as beneficiaries of college savings accounts known as 529 plans ― investment vehicles that come with a range of tax breaks. Abortion rights advocates were quick to call out the language. “This is a back-door attempt to establish personhood from the moment of conception,” Rep. Diana DeGette (D-Colo.), co-chair of the Congressional Pro-Choice Caucus, said in a statement. “The tax code is no place to define what constitutes an ‘unborn child.’ What’s next, giving a Social Security number to a zygote?” Ostensibly, the idea is that parents can get a leg up on saving for their kid’s education before he or she is even born. However, it takes care to define the terms “unborn child” and “child in utero,” in what appears to be a naked attempt to establish so-called personhood for fetuses, a popular anti-abortion tactic. Abortion foes believe that if fetuses were legally considered people, then abortion would have to be outlawed. State and federal legislation attempting to classify fertilized eggs, human embryos and fetuses as people has failed repeatedly over the years. The tax reform provision appears to be a sideways attempt at something similar. “A child in the womb is just as human as you or I yet, until now, the U.S. tax code has failed to acknowledge the unborn child,” Jeanne Mancini, president of the anti-abortion group March for Life, told Politico. There’s nothing in current law stopping parents from opening a 529 savings account before a child is born, explained Greg McBride, chief financial analyst at Bankrate.com, a personal finance site. A parent opens the account in his or her own name, and once the baby is born, changes the account beneficiary, he explained. McBride said he did this for one of his sons. “I don’t know how this makes it different,” he said. McBride said at most, the tax reform provision would allow parents to skip the step of naming a new beneficiary. “Taking a nonstop flight instead of changing planes,” he said. It’s unclear how the anti-abortion language got into the tax bill. Another anti-abortion group, however, thanked Rep. Mark Meadows (R-N.C.) “for his leadership on this important effort.” The GOP tax reform plan is still in its early stages, and it’s unclear if the anti-abortion provision will survive. Two tax policy groups ― one conservative, one progressive ― declined to speak on the topic with HuffPost. Parents use the widely popular 529 accounts to sock away money for their kids’ education expenses. The accounts come with a few tax breaks: You pay no tax on interest earned. And, if you use the money for education expenses, you don’t pay taxes when you withdraw the money, either. In some states, you also get a tax deduction for contributing money to a 529 account. So-called personhood language also made an appearance in a draft strategic plan for the Department of Health and Human Services released last month. In a note about the department’s organizational structure, HHS said its mission was to protect “Americans at every stage of life, beginning at conception.” And earlier this week, the House held a hearing on a bill that would ban abortions after six weeks of pregnancy. The ban doesn’t have a chance of passing, HuffPost’s Laura Bassett reported on Tuesday. “It’s time to emancipate every little unborn baby,” Rep. Steve King (R-Iowa) said at the hearing. The draft tax bill also offers a tax break to another of the GOP’s favorite kind of people: corporations. The proposal would reduce the corporate tax rate to 20 percent from 35 percent. Actual human children and adults fare less well. The proposal gets rid of an adoption tax credit and ends popular tax deductions on medical spending and student loan interest. Although, perhaps if fetuses can save for college, kids of the future will rack up less in school debt.

“To announce that there must be no criticism of the President, or that we are to stand by the President, right or wrong, is not only unpatriotic and servile, but is morally treasonable to the American public.”

- Theodore Roosevelt

|

|

|

|

|

Joined: Sep 2006

Posts: 8,902

Hall of Famer

|

Hall of Famer

Joined: Sep 2006

Posts: 8,902 |

A question for the anti abortion crowd that believes life begins at conception.

A fertility clinic is on fire. On one side of a room is an infant. On the other side is a container filled with 1000 fertilized eggs, fully ready for implantation, fully viable.

You only have time to go to one side of the room to save one or the other. Which do you choose? The one infant, or the 1000 ‘humans’? Why do you chose the one you chose?

|

|

|

|

|

Joined: Mar 2007

Posts: 3,549

Hall of Famer

|

Hall of Famer

Joined: Mar 2007

Posts: 3,549 |

and there was another casualty that came up on NPR on the way home yesterday. With the impending deficit spending coming, domestic programs are going to get crushed-and many people who need help are not going to get help as budgets are slashed. But charities and nonprofit groups say that simplicity comes with a price. Even though Republicans promise to preserve the deduction for charitable donations, these groups say other proposed changes in the bill will discourage giving. Steve Taylor, senior vice president and counsel for public policy at United Way Worldwide, notes that about a third of taxpayers currently itemize their deductions, including for charitable donations. "Under this new proposal, only about 5 percent of people will itemize their taxes," he says. "What that means is effectively millions of Americans that currently claim the charitable deduction will lose it." http://wfae.org/post/nonprofits-fear-house-republican-tax-bill-would-hurt-charitable-giving

|

|

|

|

|

Joined: Mar 2013

Posts: 52,481

Legend

|

OP

Legend

Joined: Mar 2013

Posts: 52,481 |

i guess i really don't care about the charity part of the deduction.

i've donated a lot of money throughout my lifetime (obviously one donation from a billionaire will match my donations 100x over) but i my personal belief is that if people are donating money just to deduct it on taxes, then it really wasn't "charitable" in the first place.

“To announce that there must be no criticism of the President, or that we are to stand by the President, right or wrong, is not only unpatriotic and servile, but is morally treasonable to the American public.”

- Theodore Roosevelt

|

|

|

|

|

Joined: Mar 2013

Posts: 52,481

Legend

|

OP

Legend

Joined: Mar 2013

Posts: 52,481 |

A question for the anti abortion crowd that believes life begins at conception.

A fertility clinic is on fire. On one side of a room is an infant. On the other side is a container filled with 1000 fertilized eggs, fully ready for implantation, fully viable.

You only have time to go to one side of the room to save one or the other. Which do you choose? The one infant, or the 1000 ‘humans’? Why do you chose the one you chose? still waiting on the talibangelicals to answer this.

“To announce that there must be no criticism of the President, or that we are to stand by the President, right or wrong, is not only unpatriotic and servile, but is morally treasonable to the American public.”

- Theodore Roosevelt

|

|

|

|

|

Joined: Mar 2007

Posts: 3,549

Hall of Famer

|

Hall of Famer

Joined: Mar 2007

Posts: 3,549 |

WASHINGTON (AP) — House Republicans on Friday quietly made changes to their far-reaching tax overhaul: Now its tax cuts would be less generous for many Americans.

A day after the GOP unveiled its plan promising middle-class relief, the House's top tax-writer, Rep. Kevin Brady, released a revised version of the bill that would impose a new, lower-inflation "chained CPI" adjustment for tax brackets immediately instead of in 2023. That means more income would be taxed at higher rates over time — and less generous tax cuts for individuals and families.

The change, posted on the website of the Ways and Means Committee, reduces the value of the tax cuts for ordinary Americans by $89 billion over 10 years compared with the legislation released with fanfare Thursday.

As wages rise, middle-class taxpayers would have more of their income taxed at the 25 percent rate instead of at 12 percent, for instance.

"The bill's like a dead fish: The more it hangs out in the sunlight, the stinkier it gets," Senate Democratic Leader Chuck Schumer pronounced after word of Brady's change. "The more people learn about this bill, the less they're going to like it

|

|

|

|

|

Joined: Mar 2013

Posts: 52,481

Legend

|

OP

Legend

Joined: Mar 2013

Posts: 52,481 |

well that's embarrassing.

i wonder how long it took the GOP to write this bill.

they had quite a few years to get this ready.

“To announce that there must be no criticism of the President, or that we are to stand by the President, right or wrong, is not only unpatriotic and servile, but is morally treasonable to the American public.”

- Theodore Roosevelt

|

|

|

|

|

Joined: Sep 2006

Posts: 8,902

Hall of Famer

|

Hall of Famer

Joined: Sep 2006

Posts: 8,902 |

A question for the anti abortion crowd that believes life begins at conception.

A fertility clinic is on fire. On one side of a room is an infant. On the other side is a container filled with 1000 fertilized eggs, fully ready for implantation, fully viable.

You only have time to go to one side of the room to save one or the other. Which do you choose? The one infant, or the 1000 ‘humans’? Why do you chose the one you chose? still waiting on the talibangelicals to answer this. My guess is we’ll be waiting forever.

|

|

|

|

|

Joined: Sep 2006

Posts: 27,719

Legend

|

Legend

Joined: Sep 2006

Posts: 27,719 |

I would save the infant

Why because the 1000 future humans have not been implanted in the mother yet, and may never be implanted

Now let me ask you if those 1000 "Humans" were 6 weeks along in their development inside of their mothers uterus. Would you save all of them and let the infant die, or let all 1,000 of them die to save the infant?

I AM ALWAYS RIGHT... except when I am wrong.

|

|

|

|

|

Joined: Sep 2006

Posts: 8,902

Hall of Famer

|

Hall of Famer

Joined: Sep 2006

Posts: 8,902 |

But life begins at conception, right? They’re not ‘future humans’ in your mind as I thought they were humans already since sperm touched egg. I’m confused.

Now in your scenario the eggs are implanted in 1000 women. So it’s diffetent as you’re asking me to chose between one infant and 1000 women.

I’d chose the 1000 women in this scenario. Pregnant or not.

|

|

|

|

|

Joined: Mar 2013

Posts: 52,481

Legend

|

OP

Legend

Joined: Mar 2013

Posts: 52,481 |

A question for the anti abortion crowd that believes life begins at conception.

A fertility clinic is on fire. On one side of a room is an infant. On the other side is a container filled with 1000 fertilized eggs, fully ready for implantation, fully viable.

You only have time to go to one side of the room to save one or the other. Which do you choose? The one infant, or the 1000 ‘humans’? Why do you chose the one you chose? still waiting on the talibangelicals to answer this.

“To announce that there must be no criticism of the President, or that we are to stand by the President, right or wrong, is not only unpatriotic and servile, but is morally treasonable to the American public.”

- Theodore Roosevelt

|

|

|

|

|

Joined: Sep 2006

Posts: 27,719

Legend

|

Legend

Joined: Sep 2006

Posts: 27,719 |

Have you ever heard ME say life begins at conception??? IMO Life begins at the point a woman becomes pregnant. SO IMO life begins when that fertilized egg is implanted into the uterus.

I AM ALWAYS RIGHT... except when I am wrong.

|

|

|

|

|

Joined: Sep 2006

Posts: 8,902

Hall of Famer

|

Hall of Famer

Joined: Sep 2006

Posts: 8,902 |

Have you ever heard ME say life begins at conception??? IMO Life begins at the point a woman becomes pregnant. SO IMO life begins when that fertilized egg is implanted into the uterus.

Can’t say for sure or not. If not fine. I guess I assumed that part wrong. Not to dodge this conversation but I’ve got to get some sleep. I’m 12 hours ahead of all you and exhausted from a long day in the Cambodian heat. Catch back up with this conversation in 6-8 hours. I’ll be back. Goodnight.

|

|

|

DawgTalkers.net

Forums DawgTalk Palus Politicus House GOP tax overhaul keeps

retirement rules

|

|